Israel’s tech ecosystem opened 2025 with strong forward momentum. Private funding volumes grew, M&A activity surged to historic highs, and public market fundraising rebounded sharply, demonstrating the ecosystem’s ability to grow even amid global uncertainty.

Q1 2025 Report

Israeli Tech Ecosystem

21 April, 2025

Editors: Yariv Lotan, VP of Product and Data; Einat Ben Ari, Senior Director Data and Insights, Startup Nation Central

Data analysis and insights: Aaron Gefen, Senior Business Data Analyst; Ahmad Sarsor, BI Developer; Kinneret Kanik-Tawil, Data Analyst Intern, Startup Nation Central

Content

Introduction

Executive Summary

Yariv Lotan

Yariv Lotan, VP of Digital Products, Development, Data and Insights

A Quarter of Growth and Global Attention

The Israeli tech ecosystem maintained business continuity and growth in early 2025, attracting increased global attention. Private funding volumes rose, M&A activity reached historic highs, and public market funding began to recover, showcasing the ecosystem’s capacity for expansion. While Q1 showed strength, Q2 opened with significant challenges in global capital markets, including the impact of growing trade tensions.

Private Funding Trends: Signs of Strong Momentum

Israel’s private funding landscape showed promising signs, with total funding reaching $3.2 billion in Q1 2025, a 12% increase from the previous quarter. This growth was driven by fewer, but larger deals, reflecting increased investor confidence in more mature companies. Mega-rounds, constituting 43% of total private funding, illustrate substantial late-stage investor appetite, but early-stage funding also grew. Median funding round size continued to grow and outpace the US.

Global Investment Comparison: Israel's Outperformance

While the global private funding environment remained mixed, Israel distinguished itself with growth in capital raised, despite a slight decrease in deal volume. This performance trend surpassed US, European, and Asian markets, reinforcing Israel’s attractiveness as a dynamic tech hub.

Mergers and Acquisitions: A Surge in Global Demand

M&A activity surged to $35.7 billion. This dramatic increase, fueled by major acquisitions like Google’s $32 billion acquisition of Wiz and Munich Re’s $2.6 billion acquisition of Next Insurance, signals strong global buyer interest in Israeli innovation and highlights Israel’s strategic importance in the international M&A landscape.

Public Markets: Recovery and Caution

Public tech companies raised $1 billion in Q1 2025, surpassing all of 2024, driven by PIPE activity, which continued to steadily grow and replace public offerings as a leading source of funding. The Finder NASDAQ Index rose 6% year-over-year, while the NASDAQ-100 equal weight dipped by 1.5%.

Investor Dynamics: A Story of Enduring Confidence

Investor activity in Israel indicates committed engagement. While the number of active investors saw a slight dip, global investors, who participated in 81% of funding rounds (the highest in two years), continue to show strong confidence in Israeli tech. This suggests a shift towards long-term strategic investments, with both local and global investors playing crucial roles in nurturing the ecosystem.

Economic Indicators and Impacts: Tech as an Economic Pillar

The high-tech sector remains a vital driver of Israel’s economic growth. Despite a 1.2% decline in local high-tech employment, the sector’s contribution to Israel’s GDP increased by 2.7%, with per-employee productivity and exports per employee both rising by 4%. This underscores the sector’s efficiency and its significant impact on the national economy.

Looking Ahead: Key Indicators for Q2 and Beyond

Several factors will shape the trajectory of the Israeli tech ecosystem in Q2 2025 and beyond. These include:

- The impact of global capital market turmoil.

- The growth or decline in tech employment.

- The progress of early-growth companies transitioning into scale-ups.

Other predictive insights include:

- Defense-related technologies, including cybersecurity and military technologies, will experience continued growth, driven by increasing defense demand and growing VC investment in defense startups.

- Growing trade tensions will likely keep the IPO window closed and limit M&A deal exits.

- Based on our Finder-NASDAQ index behavior, we cautiously predict that should the turmoil in the public capital markets continue, VC activity will slow down towards the end of the year.

In summary, while Q1 2025 demonstrated the Israeli tech ecosystem’s strength, its future hinges on navigating global economic headwinds, and on sustaining its unique growth drivers.

Yariv Lotan,

VP of Digital Products, Development, Data and Insights

Ecosystem Landscape

0

Active Tech Companies

0

Active investors in the last 12 months

Q4 2024 - Events | Q4 2024 - Amount | Q1 2025 - Events | Q1 2025 - Amount | |

|---|---|---|---|---|

Private Funding | 197 | 2.9B | 185 | 3.2B |

Funding for Public Companies | 5 | 147M | 6 | 344M |

Merger & Acquisition Exits | 25 | 2.4B | 35 | 35.7B |

Private Companies

Dr. Itamar Sivan

Co-Founder and CEO of Quantum Machines

Quantum Machines: Overcoming Challenges and Achieving Global Leadership in Quantum Control

Quantum Machines, an Israeli startup specializing in advanced control systems for quantum computers, has overcome significant challenges to achieve remarkable business milestones and establish itself as a global leader in its domain. The company’s journey exemplifies the resilience and innovation that characterize the Israeli tech ecosystem.

Founded in 2018, Quantum Machines recognized the nascent quantum computing industry’s critical need for high-performance control systems to manipulate qubits effectively. Its early focus on research and development led to a groundbreaking platform supporting a wide range of quantum processors and accelerating progress across multiple hardware modalities.

Building a deep-tech startup in a rapidly evolving field presented numerous challenges. Quantum Machines had to navigate complex technological hurdles, attract specialized talent, and secure funding in a competitive landscape. However, the company leveraged the strengths of the Israeli tech ecosystem to overcome these obstacles.

Israel’s strong foundation in quantum research, fostered by academic institutions and government initiatives, provided fertile ground for Quantum Machines’ development. Access to a skilled workforce, including engineers and scientists with quantum expertise, enabled the company to assemble a world-class team. Quantum Machines is also leading the development and operation of Israel’s National Quantum Computing Center (IQCC), a major initiative providing quantum infrastructure to the nation’s research and tech ecosystem.

The supportive investment environment in Israel, combined with the company’s strong business traction, enabled significant funding rounds. This financial backing helped Quantum Machines expand operations, accelerate product development, and form strategic partnerships with leading global players. One key collaboration is with NVIDIA on DGX-Quantum – a platform that integrates Quantum Machines’ Hybrid Control architecture with high-performance computing to connect classical and quantum systems seamlessly.

Today, Quantum Machines serves a global customer base of research institutions, universities, and commercial quantum computing companies. Its Hybrid Control platform has been adopted by over half of the active players developing quantum processors, solidifying its role as a key enabler of quantum advancement.

Israel’s quantum sector is rapidly emerging, driven by strong research support, talent, and a dynamic startup ecosystem. Quantum Machines’ achievements highlight the power of Israeli deep-tech innovation and the potential for continued growth in quantum technologies worldwide.

Private Funding Trends

Overview

In Q1 2025, Israel’s private funding reached $3.2 billion, including unreported and undisclosed rounds, reflecting a 12.1% increase compared to Q4 2024. Although the number of funding rounds declined by 6.1% to 185, this was the first quarter of growth since the Q2 2024 peak and the highest level since Q4 2022, excluding the Q2 2024 peak. This marks a significant milestone and signals growing momentum at the start of the year. Compared to Q1 2024, total funding rose by 24%, or 18% when accounting for unreported and undisclosed rounds, while deal volume dropped significantly from 255 rounds. This continues the shift toward fewer but higher-value transactions.

This quarterly growth reinforces the ongoing normalization of Israel’s funding environment, with investment amounts stabilizing at 2019 levels and investor appetite visibly strengthening. Notably, the median round size reached an all-time high, signaling growing confidence in the quality and maturity of the companies attracting capital. As deal volume narrows, the market continues to reward strong fundamentals and strategic alignment.

Private Funding - Global Comparison

Global private funding in Q1 2025 reflected a cautious but recalibrating environment, as regions adjusted to shifting economic conditions and evolving investor sentiment. While deal activity declined across the board, investment levels showed mixed dynamics, with Israel standing out as a notable outperformer. These figures do not include estimations for unreported or undisclosed amounts, meaning actual activity may be even higher.

United States: U.S. private funding soared to $103.9B in Q1 2025, boosted by OpenAI’s unprecedented $40B round, the largest private tech deal on record. Even excluding this mega-raise, overall capital deployment was exceptionally strong at $63.9B, marking one of the highest quarterly totals in recent years. Deal count reached 3,782, down 7% from the previous quarter, reflecting a continued shift toward fewer but larger investments. This quarter underscores the U.S. market’s depth, with both late-stage megadeals and a healthy funding base reinforcing investor conviction despite broader economic uncertainty.

Europe: Europe recorded $16.3B in funding, down 4.7% from the previous quarter but up from $15B in Q1 2024. While deal count fell by 20.6% quarter-over-quarter, the capital invested remains resilient, suggesting that investors are prioritizing fewer, higher-value opportunities rather than pulling back entirely.

Asia: Asia saw the sharpest quarterly contraction, with funding falling to $12.1B, a 32.5% drop from Q4 2024, and deal count down 16.7%. This marks one of the region’s steepest declines in recent quarters, signaling continued investor sensitivity to regional macro and geopolitical headwinds.

Israel: Israel stood out with reported $2.6B raised across 156 deals, a notable 13% increase in capital raised despite a 10.9% drop in deal count. This quarter’s performance outpaced both Europe and Asia in terms of relative growth.

The trend toward larger, more concentrated investments continues to define Israel’s funding environment, reinforcing its position as a resilient and attractive tech hub.

USA

Europe

Asia

Israel

Private Funding - Top Rounds

Top private investment activity in Q1 2025 was driven by strong mid-to-late stage rounds across multiple sectors. The largest round was raised by Rapyd Financial Network, which secured $500M and highlighted continued interest in Fintech infrastructure. In cybersecurity, Island raised $250M in an E round, continuing the sector’s trend of capital-intensive growth stories. Cybereason and Dream Security also closed significant undisclosed rounds, each valued at over $100M.

Industrial Technologies also saw meaningful activity, with Quantum Machines raising $170M, and Augury and Retym adding $75M in funding. Meanwhile, the Health Tech & Life Sciences sector recorded two substantial C rounds, Eleos Health and Navina, each between $55M and $60M, signaling renewed momentum after a quieter second half of 2024. Cybersecurity continues to dominate the leaderboard, claiming more than half of the top rounds, while Health Tech and Industrial Tech gained ground.

Here is a list of all companies that raised funds during Q1 2025.

Private Funding - Mega Rounds

In Q1 2025, Israel recorded 5 mega rounds totaling $1.1 billion, which made up 43% of total private funding for the quarter. This steady share highlights the continued role of scale-ups in driving capital flows.

After dropping to 20.1% in Q2 2023, the share of mega rounds in total funding climbed back above 35% throughout 2024 and into 2025. Although the number of rounds shifts from quarter to quarter, the trend shows strong demand for late-stage investments and ongoing global confidence in Israeli scale-ups.

At the same time, mega rounds represented just 3.1% of total deal count in Q1. Their small share of deals compared to their large share of funding shows how much they shape overall investment volumes.

Sector Analysis

Performance in Q1 2025

The sector analysis for Q1 2025 shows Cybersecurity remains a top performer. Although the sector includes just 507 companies, it attracted the highest amount of funding at $946M across 30 rounds and led in median deal size at $20M.

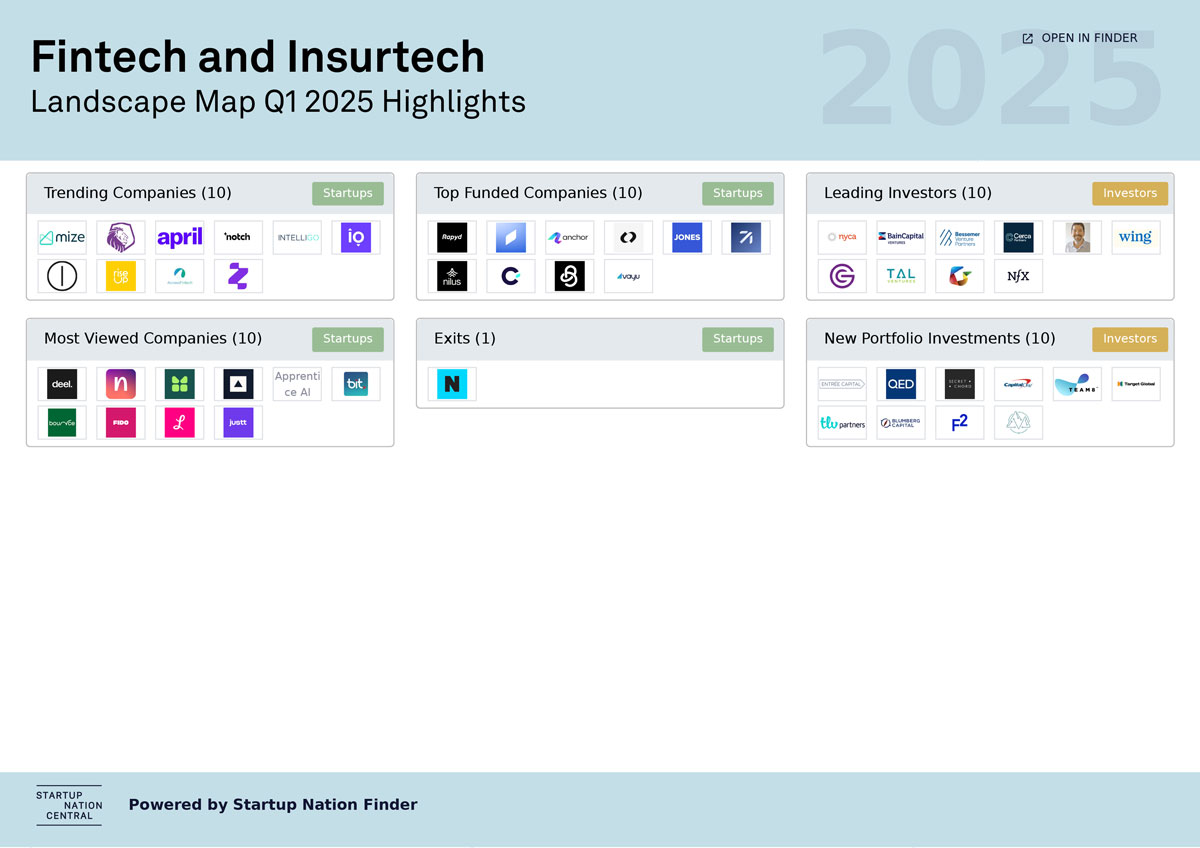

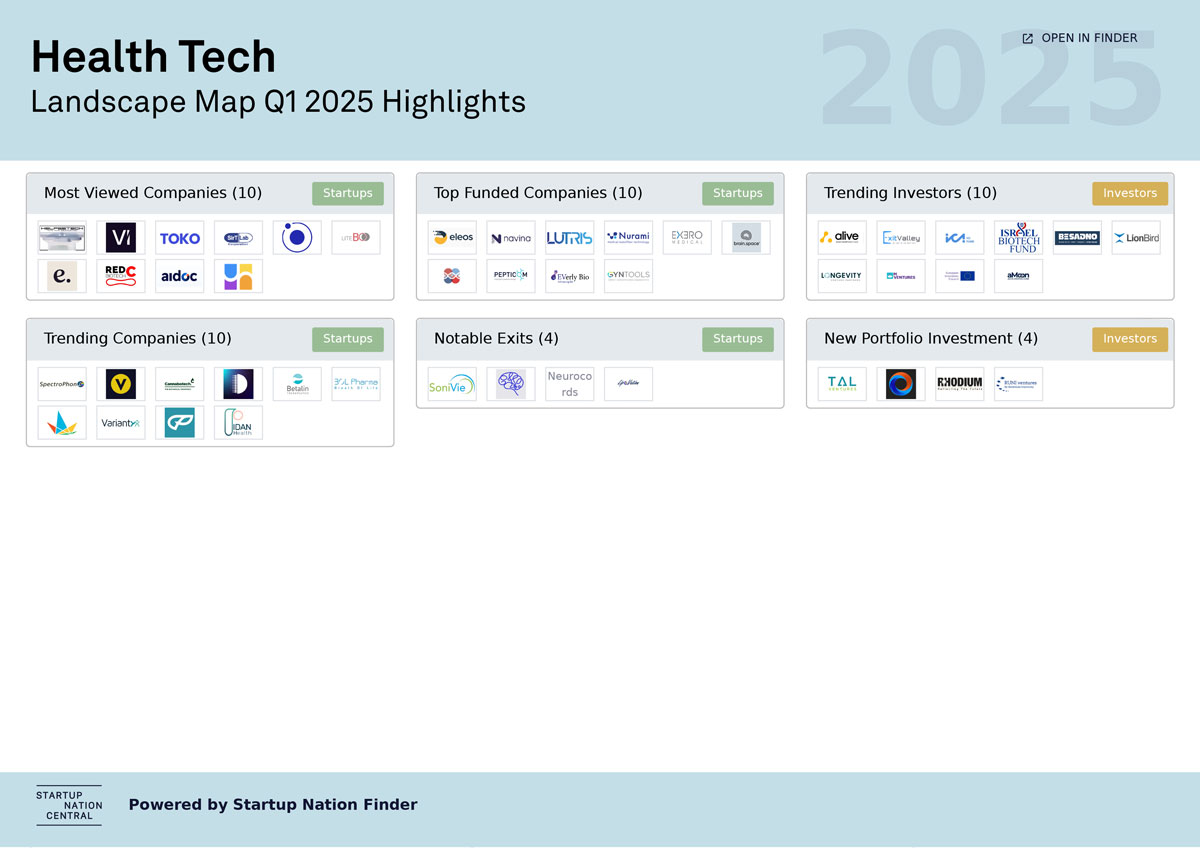

Fintech and Insurtech also stood out, raising $637M across 17 rounds with a strong median of $10M, reflecting solid investor demand. Health Tech led in deal volume with 31 rounds and raised $219M in capital.

These results point to a return to sector fundamentals, with capital flowing to areas that show clear maturity and market traction.

Sector-Level Trends: A Volatile but Informative View

Sector funding remains volatile quarter to quarter, often driven by a few large deals. But some trends are taking shape.

Cybersecurity funding rose to $946M in Q1 2025, up from $785M the previous quarter. Fintech & Insurtech more than doubled, from $274M to $637M. Industrial Tech saw the steepest jump, climbing from $67M to $296M. Health Tech, meanwhile, declined from $355M to $219M.

These shifts suggest investor momentum is moving toward infrastructure, deep tech, and fintech-driven innovation.

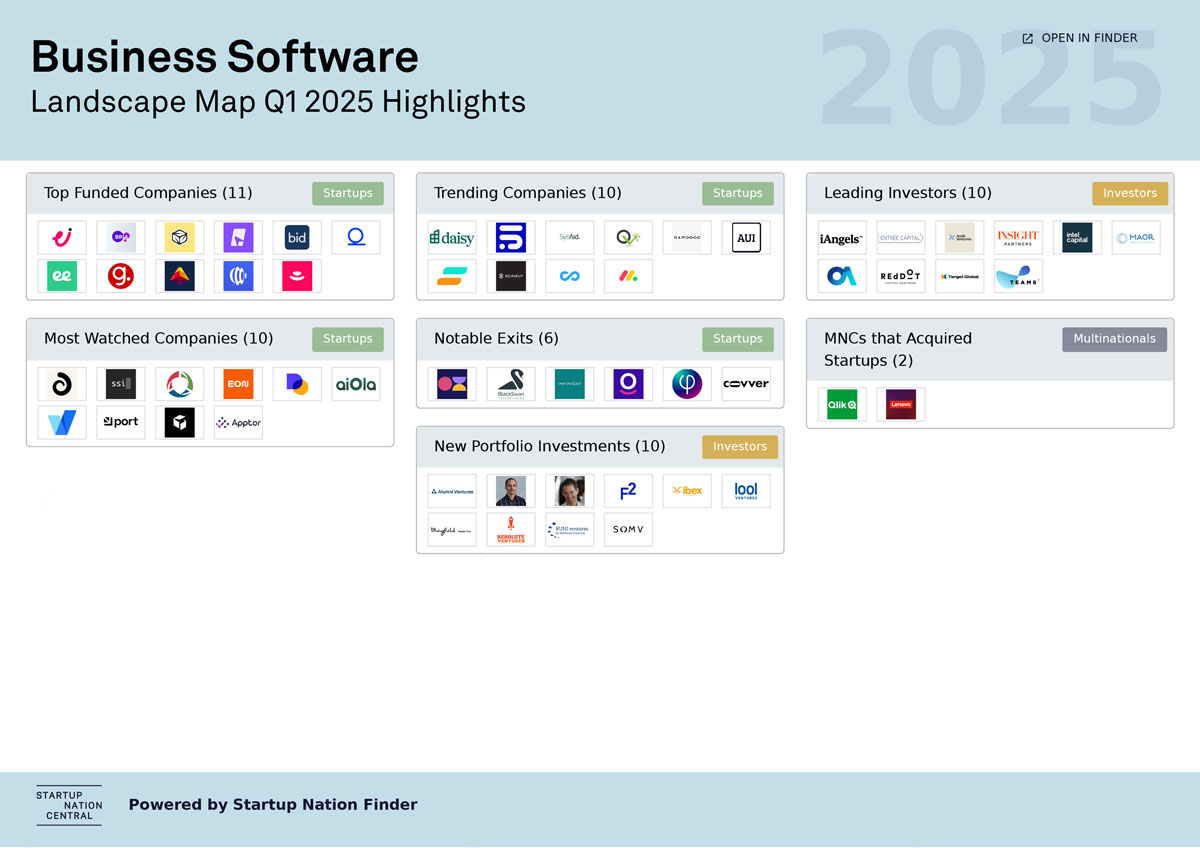

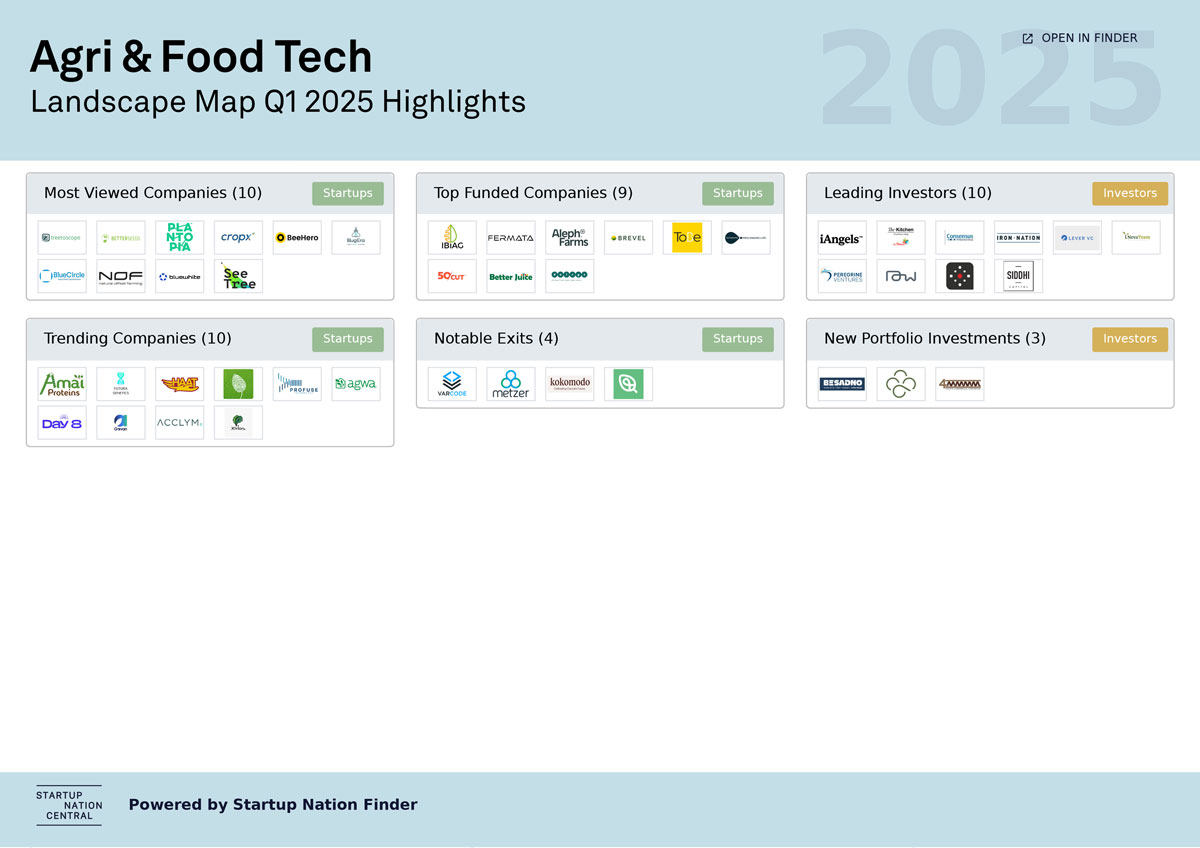

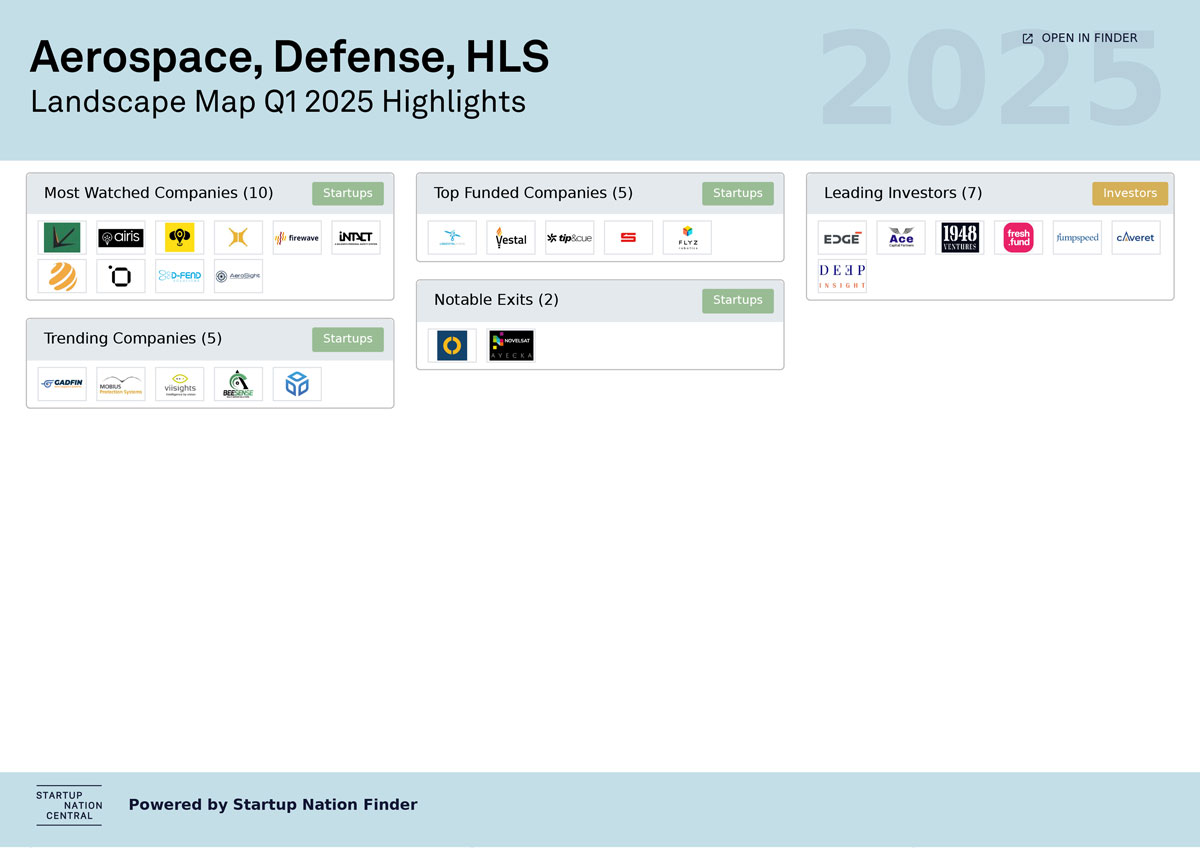

Landscape Maps of Key Sector Players

Explore detailed maps of key players across sectors, offering a clear view of the major companies and innovations shaping each industry. Use them to understand the landscape and spot opportunities in the following sectors:

Public Companies

Public Companies Funding

Public funding surged in Q1 2025, with Israeli public companies raising $1B across 30 funding events. Notable transactions included Bio89’s $250M public offering and Stratasys’s $120M PIPE. This was the highest quarterly count since early 2023 and a strong rebound from Q4 2024, which saw just $200M raised across 16 events.

The sharp increase was driven mainly by PIPE (Private Investment in Public Equity) transactions, which remain the preferred structure for public company fundraising. Public offerings also rose slightly, while IPO activity stayed limited. This mix reflects a cautious but improving capital market environment, with investors favoring flexible, lower-risk structures.

Finder NASDAQ Index

The Finder NASDAQ Index closely tracks the NASDAQ 100 Equal Weighted Index, with both moving along a similar path. In Q1 2025, the Finder Index showed greater volatility and periods of notable outperformance. It peaked well above the NASDAQ 100 EW before a sharper decline at the end of the quarter.

Despite the drop, the Finder Index maintained a stronger growth trend. It rose 6% over the past 12 months, while the NASDAQ 100 EW fell 1.5%. This suggests Israeli public companies are shaped by global forces but also benefit from sector-specific momentum. The recent downturn in both indices points to continued global market uncertainty and the adaptability of Israeli firms.

Notable Public Companies

The Top 10 Israeli public tech companies traded on Nasdaq, as tracked on the Finder platform, highlight Israel’s global strength in cybersecurity, fintech, and enterprise software. These firms continue to anchor the country’s reputation for innovation, resilience, and scale.

Leading the list is Check Point Software Technologies, with a market capitalization of $20.6B. CyberArk, Mobileye, monday.com, and Wix also remain strong performers, reinforcing the global relevance of Israeli tech.

Here is a list of all publicly traded Israeli tech companies (on the various stock exchanges) as of today.

Mergers & Acquisitions

M&A Trends

In Q1 2025, Israel’s M&A activity surged to $35.7 billion across 35 first-time transactions, more than doubling the total M&A value for all of 2024. The spike was driven by Google’s $32 billion acquisition of Wiz, the largest exits in Israeli tech history, and Munich Re’s $2.6 billion acquisition of Next Insurance. These headline deals reflect the strategic value global buyers continue to place on Israeli innovation, even in uncertain markets.

First-time M&As dominated the exit landscape, accounting for 35 of 38 total transactions, the highest quarterly count in over two years. Even without Wiz, first-time M&A value reached $3.7 billion, up 56% from Q4 2024. This strong deal volume points to sustained interest in early-stage Israeli companies and growing global confidence in the ecosystem’s long-term potential.

This early momentum reinforces Israel’s role as a global M&A hub, where buyers are not just returning but actively competing for access to the next wave of transformative tech.

Notable M&As - Scale and Sectoral Breadth

Q1 2025 was defined by Google’s $32B acquisition of Wiz, setting a new benchmark for Israeli cybersecurity exits. The second-largest deal, Munich Re’s $2.6B acquisition of Next Insurance, underscored the strength of Israel’s insurtech sector and marked one of its biggest exits to date.

Activity extended well beyond the top-line deals. Boston Scientific acquired SoniVie for $400M, and several mid-sized cybersecurity exits followed: Alterya ($150M), Vulcan Cyber ($125M), OTORIO ($100M), and CYNC ($10M). Health tech and defense also saw notable deals, with EndoStream Medical and Oosto each acquired for over $100M.

This quarter reflects strong global demand for Israeli innovation, especially in cybersecurity, health tech, and insurtech. With a mix of mega-acquisitions and high-value early exits, Israel’s M&A landscape continues to show both scale and sectoral depth.

Here is a list of all Israeli tech companies that were acquired in Q1 2025

Investors

Miriam Shtilman-Lavsovski

Partner, Tal Ventures

Lorem Ipsum

In Q1 2025, the Israeli tech sector maintained strong investor interest and successfully secured funding despite challenging conditions. Investors continue to view Israeli entrepreneurs as highly resilient, reinforcing confidence in the market. Current investment trends highlight a sustained focus on cybersecurity alongside growing interest in defense technologies and quantum computing. M&A activity also remains robust, with major players, including private equity firms, actively pursuing acquisitions. However, a surge in IPOs is unlikely in the near term, as favorable conditions, such as lower interest rates and improved financial readiness among companies, have yet to materialize.

Israel should focus its technological strengths on fields that offer strategic advantage and high barriers to entry—such as semiconductors, quantum computing, energy solutions, and advanced materials. These deep tech sectors, especially high power computing, hold immense potential for driving industrial and economic growth. While Israel may not lead in foundational AI models, its strength lies in AI applications that enhance performance and drive vertical solutions. Investors remain cautious about generative AI due to competition from major tech corporations.

Despite overall optimism, challenges persist, particularly from the global recession and the U.S. economic climate, which may impact corporate sales. Early-stage startups must demonstrate tangible results before seeking funding to build investor confidence. Once funded, financial discipline is critical amid market uncertainties. AI is reshaping company structures, enabling smaller teams to generate substantial revenue more quickly. Deep tech startups should focus on establishing a strong technological moat, securing patents, and ensuring access to long-term funding to support extended development cycles.

Investor Trends

In Q1 2025, 234 investors took part in funding Israeli tech companies, including 134 global and 100 local investors. This marks a slight decline from the previous quarter, but the core investor base remains strong, especially globally, where participation held steady.

The share of global investors dipped from 62% in Q4 to 57% in Q1. While this shift is notable, global investor numbers remain well above pre-2020 averages, signaling continued confidence in Israeli tech. Consistent engagement from global players, even as activity slows, shows the depth of long-term interest in the ecosystem.

Despite a slight drop in investor count, the Israeli tech landscape continues to show resilience. Active investors are signaling long-term commitment and helping sustain momentum as the broader funding environment begins to stabilize.

Global Investor Participation

Global investor participation jumped in Q1 2025, with global investors involved in 81% of all funding rounds. This is the highest quarterly share in over two years. It marks a sharp rise from 63% in Q4 2024 and continues an upward trend from the early 2024 low of 54%.

The data shows a return to pre-2023 levels and an even stronger reliance on international capital. It also reflects growing global confidence in Israeli tech, despite ongoing geopolitical and macroeconomic uncertainty.

Notable Investors

Local Investors

In Q1 2025, iAngels led local investor activity with 8 rounds, including 2 first-time investments. Team8 and TLV Partners followed with 6 rounds each, including 4 and 2 first-time rounds respectively. Entrée Capital took part in 5 rounds, continuing its steady involvement.

Also active were OurCrowd, Peregrine, Red Dot Capital Partners, and Tal Ventures, each participating in 4 rounds. These trends highlight the resilience and long-term commitment of Israeli investors as they continue to back the next wave of tech leaders.

Global Investors

Global investors remained active in Q1 2025. Intel Capital and Insight Partners led with 4 investments each, including 3 and 2 first-time rounds respectively, showing continued support for early-stage Israeli innovation.

Other active global investors included Joule Ventures, Maor Investments, and Lightspeed Venture Partners, each with 3 rounds. Bain Capital Ventures, Consensus Business Group, and CrowdStrike Falcon Fund also stood out, each making 2 first-time investments. These trends highlight sustained international interest, even in a more selective funding environment.

Here is a list of all investors who invested in Israel in Q1 2025

Economic Indicators & Impacts

The analysis of GDP, Exports and Local Employment was conducted in collaboration with the Aaron Institute for Economic Policy at Reichman University, using data from the Israeli Central Bureau of Statistics (CBS). Special thanks to Dr. Sergei Sumkin, Senior Researcher at the Aaron Institute for Economic Policy, for his valuable contribution.

GDP and Exports

The high-tech sector remained a key engine of Israel’s economy in 2024, contributing NIS 285B to GDP, a 2.7% increase year over year. This growth came despite a 1.2% drop in high-tech employment. GDP per high-tech employee rose by 4% to NIS 730K, reflecting continued productivity gains.

High-tech exports per employee also grew by 4%, reaching NIS 726K. The parallel rise in GDP and export productivity due to the high correlation, to align with a similar increase (ceteris paribus) in GDP per employee (labor productivity). This parallel rise in GDP and export productivity reinforces the sector’s role as an economic anchor. With Israel’s total GDP growing just 0.9% in 2024, high tech once again proved its outsized contribution to national resilience and growth.

Local Employment Trends

In 2024, Israel’s high-tech sector employed 391K workers, a 1.2% decline from 2023. R&D roles grew by 3.6% year over year, reaching nearly 198K employees. In contrast, non-R&D roles continued to shrink. Product, QA, and Data positions fell by 5.9%, while Business and Administrative roles declined by 5.6%.

Compared to Q1–Q3 data, R&D growth has slowed slightly, and the drop in non-R&D roles has eased. This points to a more gradual rebalancing toward core innovation functions.

Global vs. Local Employment Trends

Introducing Startup Nation Central’s Global Employment Indicator – a new metric designed to showcase the global footprint of Israeli tech. This indicator is the result of a comprehensive analysis using publicly available professional data, including LinkedIn and other sources, curated by our data specialists. Built on bottom-up data aggregation from over 5,000 companies, the measure is carefully weighted by sector and company stage to ensure accuracy. The result is a more holistic view of employment trends across Israeli tech companies, both in Israel and around the world.

This new metric complements the CBS data as it reflects the full geographic footprint of Israeli firms as defined by Finder excluding employees in multinational corporations (MNCs) that may have R&D centers in Israel. By contrast, CBS figures do not distinguish between startups and MNCs. While CBS employment data is better suited to measure the local economic contribution of high-tech companies to the Israeli economy, we believe that there is a need to an additional global view. Our global employment indicator, while still experimental, offers a complementary lens: it captures how Israeli tech companies operate and grow on a global scale, especially in times of local disruption. As this is an experimental indicator, exact figures can change when looked at by different institutions using diverse methodologies. However, an analysis of trends over time can reveal insights about tech employment, as discussed below.

The result is a more stable employment trendline. For example, CBS reported a 4.1% rise in Q2 2024 followed by a 5% drop in Q3. In contrast, our global dataset recorded a 2% rise and only a 0.5% decline in the same quarters. These trends remain directionally consistent, but our data shows less volatility demonstrating how global hiring may help buffer local workforce shifts.

For Q1 2025, the local and global dataset recorded a 0.5% decline, which may indicate an upcoming similar trend in CBS future reporting. This is the first time such forward-looking labor market insights have been made available, offering a potential early signal for policymakers and practitioners. As the ecosystem evolves, this approach marks a methodological leap in how we track and understand the broader dynamics of Israel’s tech workforce. We invite reader feedback regarding the methodology in order to further refine this new metric.

We invite researchers, practitioners, and policymakers to collaborate with us in refining this indicator and improving shared visibility into the global footprint of Israeli tech.

This trend may reflect two possible dynamics: either Israeli companies are increasingly hiring abroad to offset local workforce shortages, ensuring business continuity during periods of domestic instability; or, alternatively, parts of the industry may be shifting operations overseas—a potential signal of reduced local confidence. In either case, global hiring appears to be playing a critical role in shaping workforce strategy.

Some caveats remain. Global professional data may underreport layoffs, as individuals often delay updating employment status. Additionally, company coverage may differ from CBS definitions. To address this, future research will cross-reference tracked companies with CBS records and provide more granular, sector-specific insight.

Summary

In Q1 2025, Israel’s tech ecosystem showed growth and strength, with estimated private funding reaching $3.2 billion, a 12.1% increase from the previous quarter, driven by larger deals and growing investor confidence. M&A activity soared to $35.7 billion, led by Google’s acquisition of Wiz, one of the largest exits in Israeli tech history. Public market activity also picked up, with tech companies raising $1 billion, surpassing 2024’s total, although early Q2 brought signs of global market volatility.

Israel’s tech sector continues to outperform global peers, attracting significant international investment and reinforcing its strategic global position. Despite slight declines in local employment, productivity and exports per employee grew, highlighting the sector’s critical role in Israel’s economy.

The future of the Israeli tech ecosystem in Q2 2025 and beyond will be influenced by a number of factors:

- Global Trade Tensions: The impact of a potential new trade world order may bring recession fear and lead to investor caution. Based on the behavior of the Finder-NASDAQ index, there is a possibility that VC activity in Israel could slow down towards the end of the year if the turmoil in the public capital markets persists. This would have a significant impact on the funding landscape for startups. The potential for escalating trade tensions may create obstacles for Israeli tech companies, especially regarding IPOs and M&A exits. This could result in fewer exit opportunities and hinder companies from achieving their full potential.

- Tech Employment Trends: The growth or decline of tech employment in Israel will have a significant impact on the ecosystem. A strong job market will attract talent and drive innovation, while a slowdown could lead to a brain drain and a loss of competitiveness.

- Scale-Up Success: The ability of early-growth companies to successfully transition into scale-ups will be crucial for the long-term health of the ecosystem. This will require access to capital, strong management teams, and a supportive regulatory environment.

- Defense Technology Expansion: The defense technology sector, including cybersecurity and military technologies, is expected to experience continued growth. This is driven by increasing demand for advanced defense solutions and a growing interest from VC investors in defense-focused startups.

While Q1 2025 showcased the strength and innovation of the Israeli tech ecosystem, the outlook for the remainder of the year and beyond is mixed. The ecosystem faces a number of challenges, including global economic headwinds, geopolitical tensions, and a potential slowdown in investment. However, there are also bright spots, such as the booming defense technology sector and the continued strength of Israeli innovation. The ability of the ecosystem to navigate these challenges and capitalize on opportunities will determine its future success.

More on the Israeli Tech Ecosystem

Methodology Notes

- The report is based on the Startup Nation Finder database, with the following exceptions:

○ Selected metrics in the Global Comparison and Finder Index sections are based on Pitchbook.

○ Selected metrics in the Economic Indicators and Impact section are based on the Central Bureau of Statistics survey data - The report offers a snapshot of Q1 2025 activity as of March 31, 2025.

- Data might be further updated in the future. As a result, figures in this report may differ from figures in prior published reports.

- The definition and criteria for companies and investors can be found in the Finder Glossary.

- Active Investors are defined as investors with at least 1 investment round in Q1 2025.

- Aggregate metrics may include rounds that are not visible in Finder, per the request of the profile owners.

- Funding Type definitions:

○ Private Funding includes the following round types: Pre Seed, Seed, A, B, C, D, E, F, G Rounds, Convertible Debt, SAFE, Equity Crowdfunding, and Undisclosed rounds.

○ Funding for Public companies includes the following event types: IPO (including IPO via SPAC or Reverse Merger), Non-Initial Public Offering, PIPE.

○ The following events are excluded: Crowdfunding, Debt Financing, Secondary, and Grants. - Some Finder lists are dynamic and provide current snapshots. Hence the results might not match the figures in the report.

- The Finder Index is an index calculated by Startup Nation Central, based on Israeli companies traded in NASDAQ with a $50 million market cap minimum threshold and using an equal-weighting methodology.

About Us

Startup Nation Central is a free-acting NGO providing global solution seekers frictionless access to Israel’s bold and impatient innovators to help tackle the world’s most pressing challenges. Our free business engagement platform, Finder, grants unrestricted access to real-time, updated information and deep business insights into the Israeli tech ecosystem.