Aerospace, Defense & HLS Landscape Map

Business Analysis: Ilana Sherrington, Director Global Partnerships, Startup Nation Central

Research Analyst: Ayelet Shinebox, Data Specialist, Startup Nation Central

Editor: Einat Ben Ari, Senior Director of Data & Insights, Startup Nation Central

Finder Spotlight, December 1, 2025

Ecosystem Contributors:

Introduction

In Israel, innovation in Aerospace, Defense, and Homeland Security (HLS) is driven by necessity, and technology is rapidly deployed to solve real-world challenges. From early-stage startups to established industry leaders, the ecosystem responds swiftly to emerging threats and operational needs—creating scalable solutions that are increasingly adopted worldwide.

With over 312 companies active across Aerospace, Defense, and HLS technologies, the country has become a critical player in advancing next-generation security solutions, including autonomous systems, cyber defense, dual-use aerospace, and smart border technologies.

These landscape maps offer a curated overview of the trends and innovation clusters redefining the Aerospace, Defense, and HLS sectors. It serves as a strategic guide for investors, corporates, and global partners navigating one of the most complex and high-impact arenas of innovation.

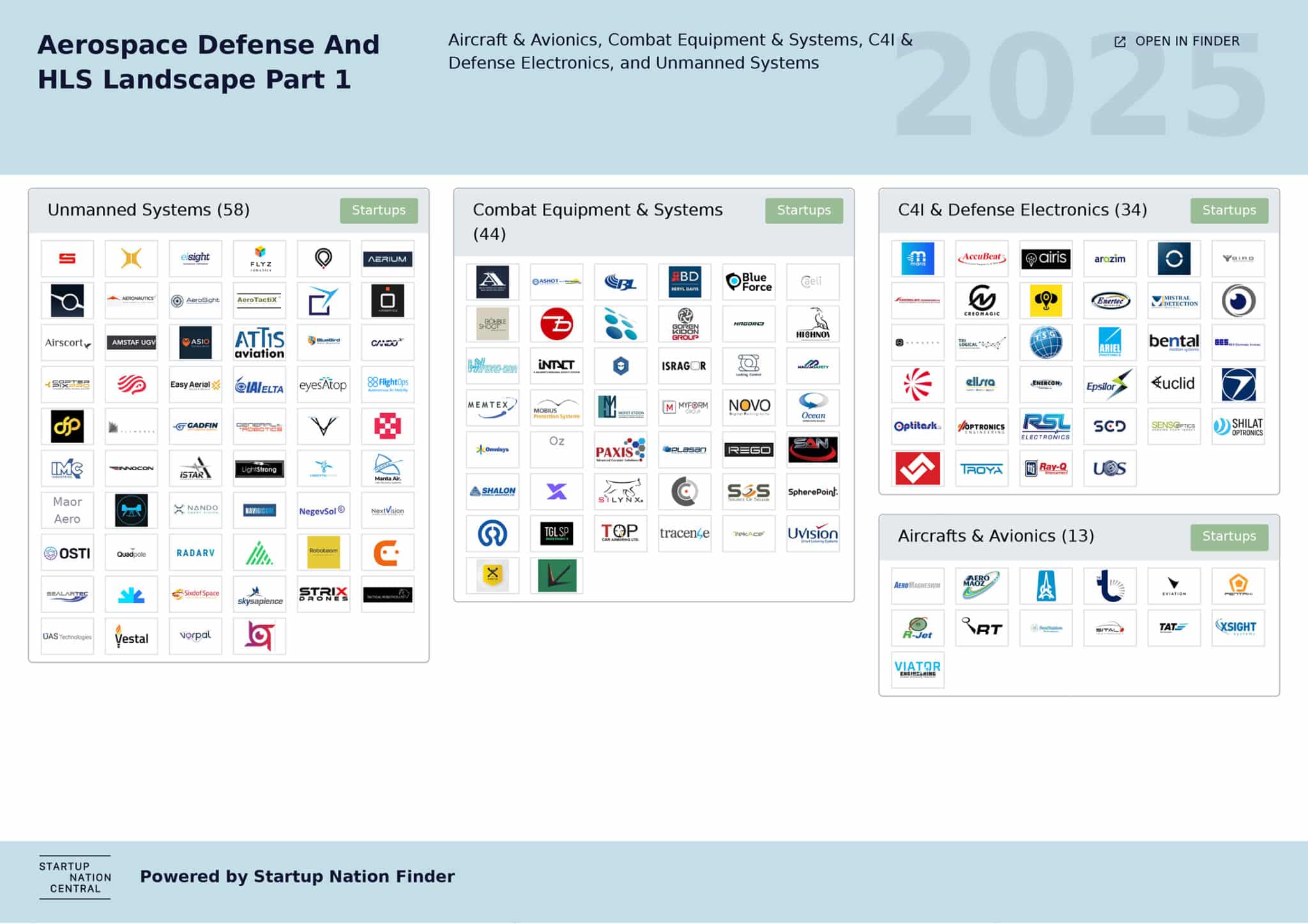

MAP 1: Aircraft & Avionics, Combat Equipment & Systems, C4I & Defense Electronics, and Unmanned Systems

Or Liban, Head of Middle East, Airwallex, noted: “We are seeing a fundamental shift where businesses no longer need traditional banking infrastructure to scale globally—technology is replacing old financial rails faster than ever.”

- Aircrafts & Avionics – Technologies enabling aerial weapon upgrades, advanced aerostructures, sensor integration, targeting, reconnaissance, self-defense, and aircraft modernization.

- Combat Equipment & Systems – A wide array of tools and technologies designed for military and law enforcement use. These include advanced weaponry, tactical vehicles, and communication systems. Advanced protective gear such as body armor, helmets, and specialized suits are likewise included.

- C4I & Defense Electronics – Provides secure communication, intelligence gathering, and real-time decision-making in defense operations. These systems combine sensors, encrypted networks, and advanced processing to ensure seamless coordination and situational awareness. From signal processing to thermal imaging and stabilized optics, they improve communication, surveillance, and threat detection.

- Unmanned Systems – Encompassing autonomous and remotely controlled technologies, including UAVs, UGVs, USVs, and robotics, equipped with advanced sensors, AI, and communication modules for tasks in Aerospace, Defense and more. These systems leverage satellite and spacecraft technologies for data transmission, signal processing, precise location determination, surveillance and movement control.

Explore the Landscape Map

- HLS – Security & Surveillance Integration – The process of combining various security and surveillance systems to work together seamlessly. This ensures that different components, such as cameras, sensors, alarms, and monitoring systems, are coordinated to enhance overall security and surveillance capabilities. It often involves the use of software platforms that allow for centralized control, real-time monitoring, and data analysis to improve situational awareness and response times in security operations.

- Simulations & Training- Leveraging technologies like virtual reality (VR), augmented reality (AR), computer simulations, advanced sensors, and artificial intelligence (AI) to create realistic training scenarios to improve decision-making and readiness, boost mission effectiveness and strengthen readiness across aerospace, defense, and HLS sectors.

- Space Tech – Involves designing, developing, and operating devices and systems for space travel and exploration, including satellites, instruments, and spacecraft. Recent innovations, such as reusable spacecrafts, 3D printing for in-space manufacturing, and suborbital spaceplanes, enhance sustainability and accessibility in space exploration and commercial space tourism.

Explore the Landscape Map

Israeli Defense Tech

Ilana Sherrington, Director Global Partnerships

Forged in resilience and tested by real-world security demands, Israel’s defense tech sector is redefining global security. As emerging threats accelerate, nations can’t afford to react—they must anticipate. With warfare shifting to cyber, autonomous, and space-based technologies, Israel’s relentless innovation cycle, shaped by necessity and battlefield testing, provides a critical edge. This isn’t just about keeping pace; it’s about leading the future of defense.

Defense Tech Data and Trends

As of early 2025, Israel has 312 active aerospace and defense companies. From 2020, the sector experienced steady growth, with a more marked increase starting in 2023. This expansion was driven by global and regional conflict and growing demand for advanced military technology.

Israeli Aerospace, Defense & HLS Companies 2025 Funding Stages

The majority of companies in the sector are in the early stage (42%) followed closely by mature companies (39%). Very few companies are in the early growth stage (3%), and the remaining 16% were either acquired (9%) or went public (7%).

Private Funding: Sector Recovery and Adaptability

The sector shows volatility in private funding, peaking at $429M in 2021 before dropping to $69M by 2023. Both the peak and the decline reflect the overall trends observed in the Israeli tech ecosystem. However, in 2024, the sector recovered with $172M in private funding, partly driven by increased demand following Israel’s defense needs. This recovery highlights the sector’s adaptability, resilience, and rapid mobilization.

Detailed funding information can be found in the Investors in Aerospace, Defense & HLS watchlist

Dual–Use Technologies in the Defense Sector

Security & Surveillance Integration (HLS) has the highest number of dual-use companies, making up 48% (46 out of 96) of the sector. These technologies are applicable to both civilian safety (e.g., smart cities) and military reconnaissance. Other Categories with dual-use applications include: Combat Equipment & Systems (42%), Unmanned Systems (33%), Defense Electronics & C4I (29%), Aircraft & Avionics (50%), and Simulations & Training (18%).

Summary

The 2025 Aerospace, Defense & HLS Landscape Map offers valuable insights for investors, policymakers, and industry leaders looking to navigate Israel’s fast-evolving defense ecosystem. As global conflicts drive defense tech demand, Israel’s innovative solutions, cutting-edge technologies, and resilient ecosystem continue to position it at the forefront of military and security advancements.

Methodology

The companies featured in this spotlight and on the associated map were selected based on key indicators of innovation and impact, including recent funding rounds or government grants, notable milestones, strategic partnerships, and the uniqueness of their technology.

The report is based on the Startup Nation Finder database, except for global funding metrics, which are based on Pitchbook. Private Funding includes the following round types: Pre Seed, Seed, A, B, C, D, E, F, G Rounds, Convertible Debt, SAFE, Equity Crowdfunding, and Undisclosed rounds.

About Us

Startup Nation Central is a free-acting NGO providing global solution seekers frictionless access to Israel’s bold and impatient innovators to help tackle the world’s most pressing challenges. Our free business engagement platform, Finder, delivers unrestricted access to real-time, updated information and deep business insights into the Israeli tech ecosystem.