Fintech Spotlight: Building the Future of Intelligent Finance

Editor: Yariv Lotan, VP of Product and Data, Startup Nation Central

Analyst: Doron Bobman, Sector Specialist, Startup Nation Central

Ecosystem Contributors:

Introduction

Israel’s fintech sector has established a presence in the global payments and banking landscape, contributing to innovation in transaction processing, security, and digital financial services. Leveraging expertise in areas such as cybersecurity, artificial intelligence, and payment infrastructure, Israeli companies participate in global payment processing, open banking, and embedded finance initiatives.

Israeli fintech companies are facilitating cross-border payments, deploying AI-based fraud detection tools, and developing platforms for real-time transactions. These technologies enhance the speed, security, and efficiency of financial services. International businesses utilize Israeli-developed payment orchestration platforms, digital wallet technologies, and open banking APIs for operational enhancements and improved financial accessibility. The demand for real-time transactions and embedded financial services is driving ongoing development within the sector.

The fintech industry in Israel is expanding beyond core payment processing functionalities. Companies are exploring integrated financial ecosystems, incorporating automated compliance solutions, financial data analysis, and AI-driven banking infrastructure. With a focus on international markets and technological development, Israel’s fintech sector is adapting and contributing to ongoing changes in payments and digital banking.

Global Perspective

The fintech landscape is transforming, driven by embedded finance, evolving payment infrastructure, and AI’s game-changing opportunities. Non-banking entities are increasingly integrating banking and payment solutions into their platforms to streamline financial services. At the same time, AI-powered risk management and fraud detection are reshaping financial security and cross-border payments are shifting toward general API-driven solutions, bypassing traditional banking infrastructure to reduce costs and improve efficiency.

Or Liban, Head of Middle East, Airwallex, noted: “We are seeing a fundamental shift where businesses no longer need traditional banking infrastructure to scale globally—technology is replacing old financial rails faster than ever.”

While fintech investment slowed in recent years, global markets are stabilizing, with investors prioritizing sustainable profitability over rapid expansion. Compliance demands are rising, particularly around AML and data security, creating both challenges and opportunities for fintech firms. However, demand remains high, especially in emerging markets like Asia and Latin America, where digital payments and alternative banking models for unbanked populations are rapidly expanding. As real-time payments and open banking gain traction worldwide, fintech players must balance innovation with regulatory adaptation to thrive in this evolving financial ecosystem.

Global Comparison

This comparison illustrates the rise and adjustment of the global fintech sector over recent years. In 2021, fintech investments soared, with investors prioritizing scaling over profitability and pouring capital into startups. However, as interest rates and global uncertainty rose, the sector—highly sensitive to capital costs—faced a sharp correction, leading to a decline in deal volume and investments.

Currently, firms have shifted towards sustainability and efficiency, focusing on profitability, compliance, and AI-driven automation. While private funding remains selective, the sector is stabilizing as companies adapt to new market realities and explore both global opportunities and a gradually opening local landscape.

Israel

United States

Europe

Asia

AI’s Transformative Role in Fintech

Luis Pazmino Diaz

Industry Principal for Financial Services, MongoDB

Artificial intelligence is transforming financial services, driving innovation across banking, payments, and risk management. Financial institutions are leveraging AI to streamline compliance, enhance security, and deliver personalized customer experiences, all while improving transaction efficiency. The payments sector, in particular, has embraced AI-driven automation, enabling real-time transaction approvals, predictive fraud detection, and seamless settlement processes. These advancements reduce costs, accelerate processing times, and strengthen financial security, allowing institutions to proactively manage risks and optimize operations.

Beyond payments, AI is revolutionizing lending, credit assessment, and financial planning. Traditional credit models often struggle to assess risk accurately, particularly for individuals who are unbanked or have limited financial history. AI-driven credit assessment tools leverage alternative datasets—such as transactional behavior, employment patterns, and real-time financial activity—to make more precise lending decisions. In corporate finance, AI facilitates automated cash flow forecasting and real-time risk analysis, improving liquidity management and financial planning.

However, modern fintech solutions require a robust data infrastructure capable of supporting the AI-driven advancements. Legacy banking systems often lack the flexibility to integrate real-time analytics and decision-making, creating barriers to innovation. To address this, fintech firms are developing API-based AI solutions that enhance connectivity with existing platforms, enabling seamless data analysis and automation of regulatory processes. Scalable and adaptable data management platforms, such as MongoDB, are playing a key role in this transformation. With flexible schemas designed to handle a large variance of both structured and unstructured data, these technologies are helping fintech companies unlock AI’s full potential in their core offerings.

As we advance in the digitization of financial services, security is becoming more crucial than ever before. Cyber-attacks and digital vulnerabilities are significant concerns for CIOs today. Consequently, new fintech innovations should be designed with security as a fundamental principle, not only to comply with future regulations but also to maintain the stability and integrity of financial markets.

Strength of Israeli Companies

Israel’s fintech sector stands out for its adaptability, technological prowess, and global impact. The country’s strong foundations have positioned fintech firms to excel in payment processing, fraud prevention, and embedded finance. While funding in the sector peaked in 2021, reflecting global investment trends, Israeli firms have pivoted towards efficiency and sustainability rather than hyper-growth. Today, Israeli fintech firms are prioritizing B2B solutions, payment orchestration, and AI-driven automation, where they hold a strong competitive edge. A new wave of second-generation fintech startups, founded by veterans of leading Israeli fintech firms, is further strengthening the ecosystem with deep industry expertise and global experience.

Yet, despite its global success, Israel’s fintech industry faces a significant challenge—its innovations are widely used abroad but remain underutilized in the local market.

Shmuel Ben-Tovim, President of The Israel Fintech Center, notes: “There is a striking gap between the ingenuity of Israel’s Fintech industry—whose innovations serve billions worldwide—and the relatively low level of adoption of these technologies in the local market. While regulatory challenges and business considerations may explain this disparity, closing the gap should be a top priority for all stakeholders.”

Nevertheless, open banking regulations and rising demand for secure, real-time transactions are creating new opportunities. To maintain leadership, companies must continuously refine AI-driven automation, enhance digital payment infrastructures, and navigate evolving regulatory landscapes. By overcoming these hurdles, Israel’s fintech sector can strengthen its position both locally and internationally.

Israel’s Fintech Evolution: Growth, Challenges, and AI

Nofar Amikam

Managing Partner, Glilot Capital

Fintech remains one of Israel’s most significant and resilient tech sectors, second only to cybersecurity. Despite a slowdown in funding, the industry continues to thrive, with Israeli startups leading in payments, risk management, fraud, and financial infrastructure.

The fintech ecosystem is evolving rapidly, driven by many factors—but none will be more transformative than AI. In banking, AI will enhance credit risk assessment, fraud detection, and personalized services. In corporate finance, AI-powered automation will revolutionize cash flow management and forecasting, delivering real-time insights and actionable data. Who will be the real game-changer? Companies that build a unified financial data fabric and layer AI-powered applications on top will win over CFOs and lead the fintech market.

A defining strength of Israel’s fintech ecosystem is its ability to produce both global fintech leaders and highly specialized deep technologies. The country has a growing base of seasoned fintech entrepreneurs alongside AI experts, many of whom gained experience at major companies and are now launching the next generation of startups. As in cybersecurity, this cycle of talent renewal is strengthening the sector. Additionally, Israel’s large-scale fintech companies are becoming acquirers and key distribution partners, allowing startups to grow without immediately expanding abroad. This ecosystem effect is helping Israeli fintech firms scale smarter and build lasting business models.

However, challenges remain, particularly in navigating global financial regulations. Unlike cybersecurity, where solutions can be deployed anywhere, fintech companies must tailor their offerings to different compliance frameworks, making international expansion more complex. Yet, Israel’s fintech startups are proving exceptionally adaptable, leveraging strong technological expertise to create solutions that meet both local and global financial needs. With a focus on financial automation, risk management, and embedded finance, Israeli fintech is not only keeping pace with global trends—it is actively shaping the future of financial technology.

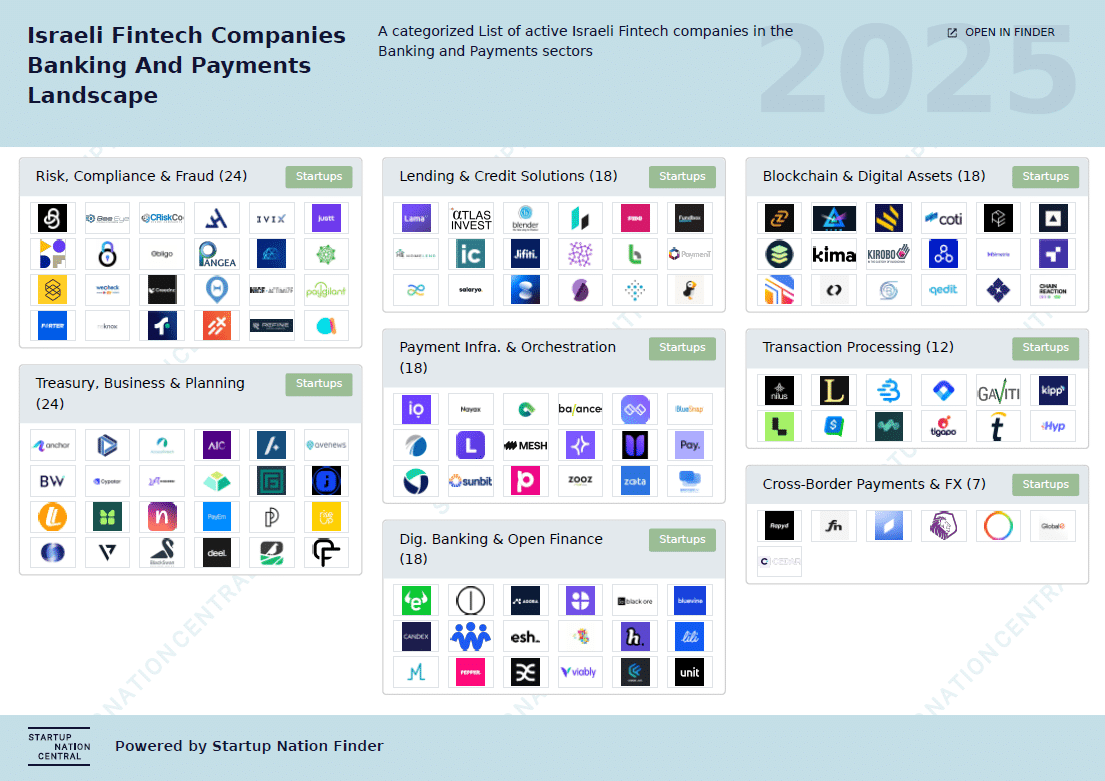

Mapping the Israeli Landscape of Banking and Payments

Israeli startups are transforming the fintech landscape across several key areas. From digital payments and banking, to lending, compliance, and financial infrastructure, these companies are building innovative solutions with global reach. Israel’s fintech sector is driving the future of financial technology.

Explore the Israeli Fintech Banking and Payments landscape map

Banking and Payments Market Data and Trends

As of early 2024, there are 217 active banking and payment companies in Israel. Their number has experienced significant growth over the past decade, rising from 76 companies in 2014 to a peak of 228 in 2022. Growth was particularly strong between 2015 and 2018, followed by steadier expansion. From 2023 onwards, the number of active companies slightly declined. Despite this recent downturn, the overall trend over the past decade reflects substantial growth in Israel’s fintech ecosystem.

The fintech sector in Israel is largely composed of small and mid-sized companies. About 72% of fintech firms have fewer than 50 employees. Only a small fraction (10%) have scaled beyond 200 employees, highlighting the sector’s fragmentation and the dominance of a small number of startups.

Funding stage analysis reveals that the fintech ecosystem is still maturing. Nearly 70% of the companies are early-stage, emphasizing a strong pipeline of new ventures. Meanwhile, only a small percentage have reached later stages, gone public, or been acquired.

Number of Companies by Employees Count

Number of Companies by Funding Stage

The Treasury, Business & Planning category dominates the fintech sector, both in company count and private funding, with 39 companies and nearly $3B in funding. Risk, Compliance & Fraud and Blockchain & Digital Assets follow, with 36 and 33 companies, respectively.

Interestingly, while Cross-Border Payments & FX has the fewest companies (12), it has attracted $1.5B in funding, surpassing several larger categories in capital raised.

Startups specializing in Banking and Payments encompass several domains:

Payment Infrastructure & Orchestration

Israeli fintech companies are revolutionizing digital payments by providing businesses with powerful payment orchestration platforms that integrate multiple financial services into a seamless, automated workflow. These platforms act as smart payment enablers, optimizing routing, approval rates, and compliance while reducing inefficiencies.

Notable Israeli Companies

“The ability to customize payment flows and maximize transaction success rates is what differentiates Israeli fintech from global competitors.” – Ran Cohen, Co-Founder & CEO, BridgerPay

Transaction Processing

Payment technology in Israel is advancing with next-generation transaction processing solutions that directly handle, authorize, and settle payments in real time. These platforms serve as payment processors and gateways, executing secure, high-speed transactions for businesses and consumers while enhancing fraud prevention and compliance.

Notable Israeli Companies

The real advantage today is in flexibility—businesses need infrastructure that adapts to different markets, payment methods, and regulations without friction.” – Or Liban, Head of Middle East, Airwallex

Cross-Border Payments & FX

Cross-border payment solutions are streamlining global transactions, allowing businesses to process international payments with minimal friction. Israeli fintech firms leverage AI and advanced payment infrastructure to increase transaction speed, lower costs, and ensure compliance with global regulations.

Notable Israeli Companies

Risk, Compliance & Fraud Prevention

As financial fraud becomes more sophisticated, Israeli fintech firms are pioneering AI-powered risk management and fraud prevention solutions. These technologies help businesses and banks detect anomalies, automate compliance, and mitigate security threats in real-time.

Notable Israeli Companies

- Just – Chargeback Management Solution for Merchants

- Forter – Fraud Prevention for Ecommerce

- Obligo Technologies – Rental Billing Authorization Solution

Integrated Digital Banking & Open Finance

Israeli fintech companies are merging digital banking with open banking APIs to embed services like payments, lending, and more directly into platforms. This integration creates seamless, personalized financial experiences and drives financial inclusion.

Notable Israeli Companies

- ONE ZERO Digital Bank – Digital Private Banking

- Unit Finance – Banking Service Integration for Tech Companies

- Lili – Mobile Banking and Tax Tools for Freelancers

“Product-led companies are becoming financial hubs, embedding services that were traditionally exclusive to banks.” – Keren Aviasaf Migdal, CEO of PaymentsOp

Lending & Credit Solutions

Israeli startups are developing innovative lending platforms that provide businesses and individuals with faster, data-driven credit solutions. AI-powered underwriting and alternative credit scoring models enable fintech firms to expand credit access while minimizing risk.

Notable Israeli Companies

- Lama AI – AI-powered Lending Exchange for Small Businesses

- FundBox – AI-powered Financial Platform for Small Businesses

- Shareagain – Lending Market to Individual Investors

Treasury, Business Finance & Financial Planning

The digital transformation of corporate finance is driving demand for automation in treasury management and business financial planning. Israeli fintech companies are developing AI-driven platforms that help CFOs optimize cash flow, forecast financial performance, and manage risk.

Notable Israeli Companies

Financial teams want automation to eliminate human errors, cut costs, and gain real-time visibility into cash flow.” – Nofar Amikam, Managing Partner, Glilot Capital

Blockchain & Digital Assets

Israeli fintech firms are exploring blockchain applications beyond cryptocurrency, with innovations in smart contracts, digital asset custody, and decentralized finance (DeFi). These technologies enhance transparency, security, and efficiency in financial transactions.

Notable Israeli Companies

- Fireblocks – End-to-end Security Platform for Transferring Digital Assets

- Kirobo – Blockchain Solution to Protect Crypto Assets

- StarkWare Industries – Zero-knowledge Proof System for Blockchains

Summary

After several years of declining investment and market uncertainty, Israel’s fintech ecosystem is entering a new era of growth and opportunity. Investment momentum is returning, with global demand for AI-driven financial solutions, real-time payments, and embedded finance fueling innovation. Israeli fintech companies are no longer just responding to trends—they are shaping them by developing next-generation financial technologies that integrate seamlessly across industries. While the focus remains on scaling internationally, the local market is also evolving, with regulatory shifts and institutional openness creating new opportunities at home.

As the sector matures, the new wave of Israeli fintech is more strategic, infrastructure-driven, and globally connected. Companies are expanding beyond niche solutions, building comprehensive financial ecosystems that cater to both international and domestic markets. With the global financial landscape embracing digital transformation, Israeli fintech is well-positioned to lead, balancing global ambition with a strengthening local foundation.

Methodology

The companies featured in this spotlight and on the associated map were selected based on key indicators of innovation and impact, including recent funding rounds or government grants, notable milestones, strategic partnerships, and the uniqueness of their technology.

The report is based on the Startup Nation Finder database, except for global funding metrics, which are based on Pitchbook. Private Funding includes the following round types: Pre Seed, Seed, A, B, C, D, E, F, G Rounds, Convertible Debt, SAFE, Equity Crowdfunding, and Undisclosed rounds.

About Us

Startup Nation Central is a free-acting NGO providing global solution seekers frictionless access to Israel’s bold and impatient innovators to help tackle the world’s most pressing challenges. Our free business engagement platform, Finder, delivers unrestricted access to real-time, updated information and deep business insights into the Israeli tech ecosystem.