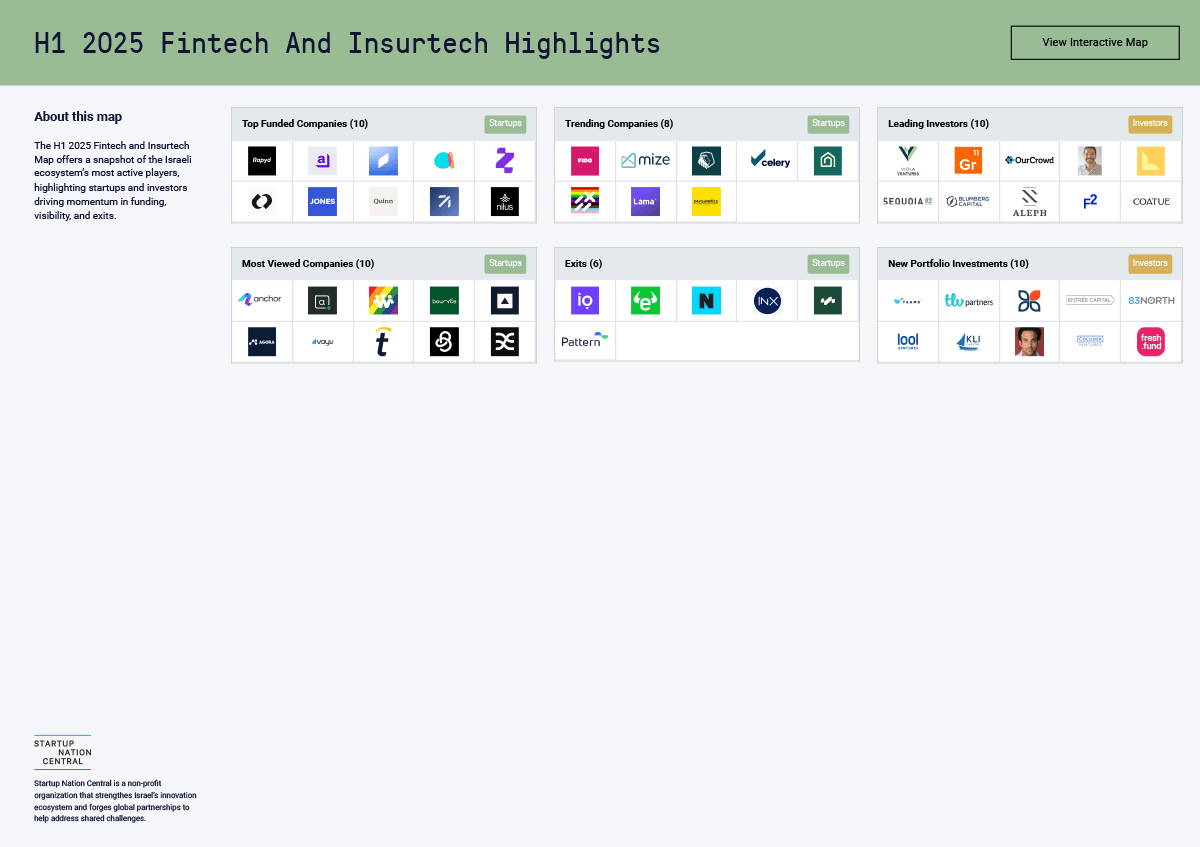

The first half of 2025 proved eventful and significant for the Israeli tech ecosystem. The quarter began with a cooling of market enthusiasm following the Trump Administration’s tariff announcement, which sparked concerns about potential global economic strain and instability. As uncertainty grew, the markets retraced their gains from the previous quarter. Despite these ongoing economic and geopolitical challenges, the sector demonstrated strong execution and capital efficiency. Key milestones included the eToro IPO, a monumental event for Israel and a rare fintech public offering, further solidifying Israel’s position on the global tech map alongside companies like Mobileye and monday.com. The war with Iran, while dramatic, concluded on an optimistic note, as evidenced by the significant rise in the Tel Aviv Stock Exchange, through the war and continuing even after the ceasefire, hinting at a potentially positive tipping point for the region.

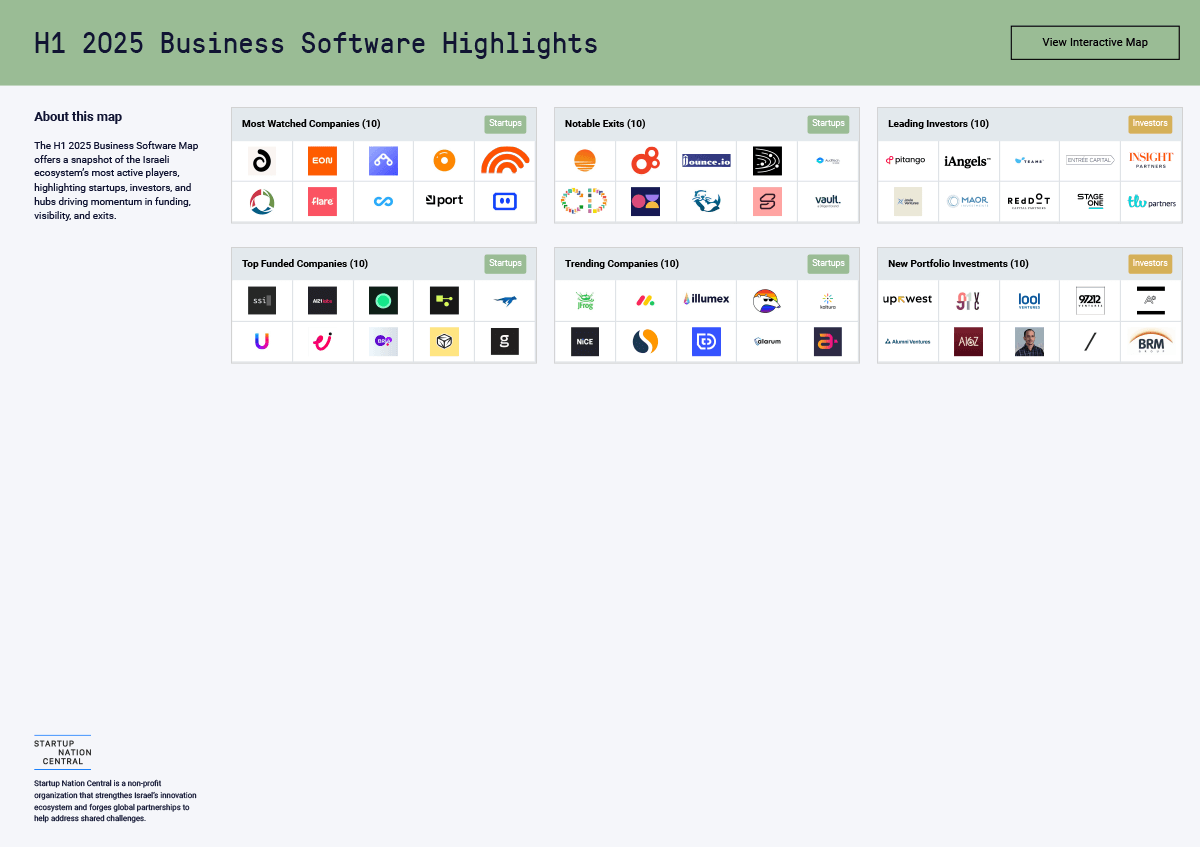

This period saw companies actively dealing with the evolving landscape. AI technology is a major driver of capital efficiency, enabling entrepreneurs to achieve more with less. Development cycles are shorter, and the role of developers has shifted, emphasizing AI utilization over traditional technical prowess. This allows smaller teams and even individual founders to accomplish significant product development, as exemplified by cases like Base44.

Investment sentiment, while not at 2021 peaks, showed a definite improvement over the previous year, with increased appetite from investors. However, many remain cautious, adopting a “wait and see” approach. While top-tier companies continue to secure funding effortlessly, challenges persist for younger startups lacking product-market fit or operating outside the hottest sectors like cybersecurity and defense. This also extends to VCs themselves, who face difficulties in raising capital from new investors, largely due to global factors like higher interest rates, fewer recent exits, and the lingering effects of the 2021-2022 valuation reset.

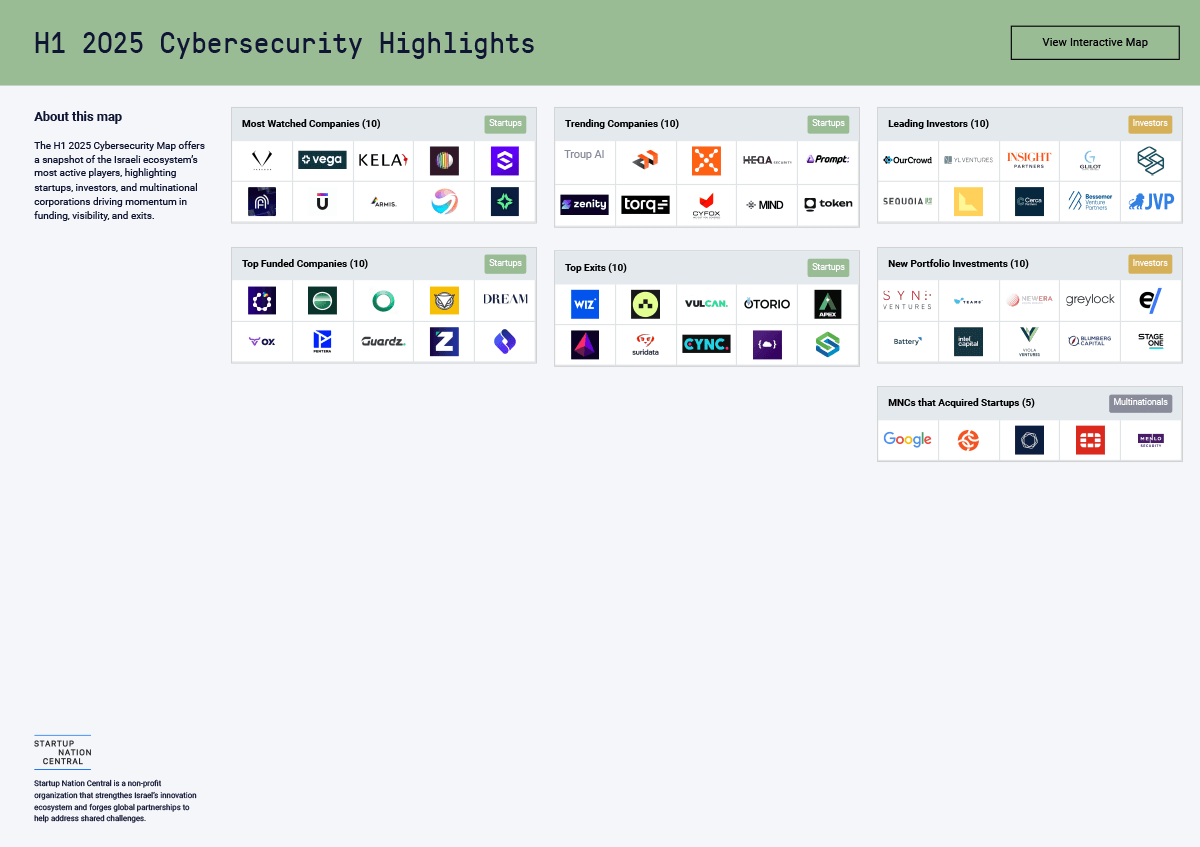

The presence of major Israeli global tech companies like Wix and monday.com, alongside international giants like Google, fosters a dynamic M&A environment, as these larger entities acquire smaller, innovative startups to stay at the cutting edge. In terms of human capital, there is fierce competition for top talent, especially in Cyber and AI. The demand for talent in these areas is so high that acquisitions for talent alone (acquihire) are increasingly common.

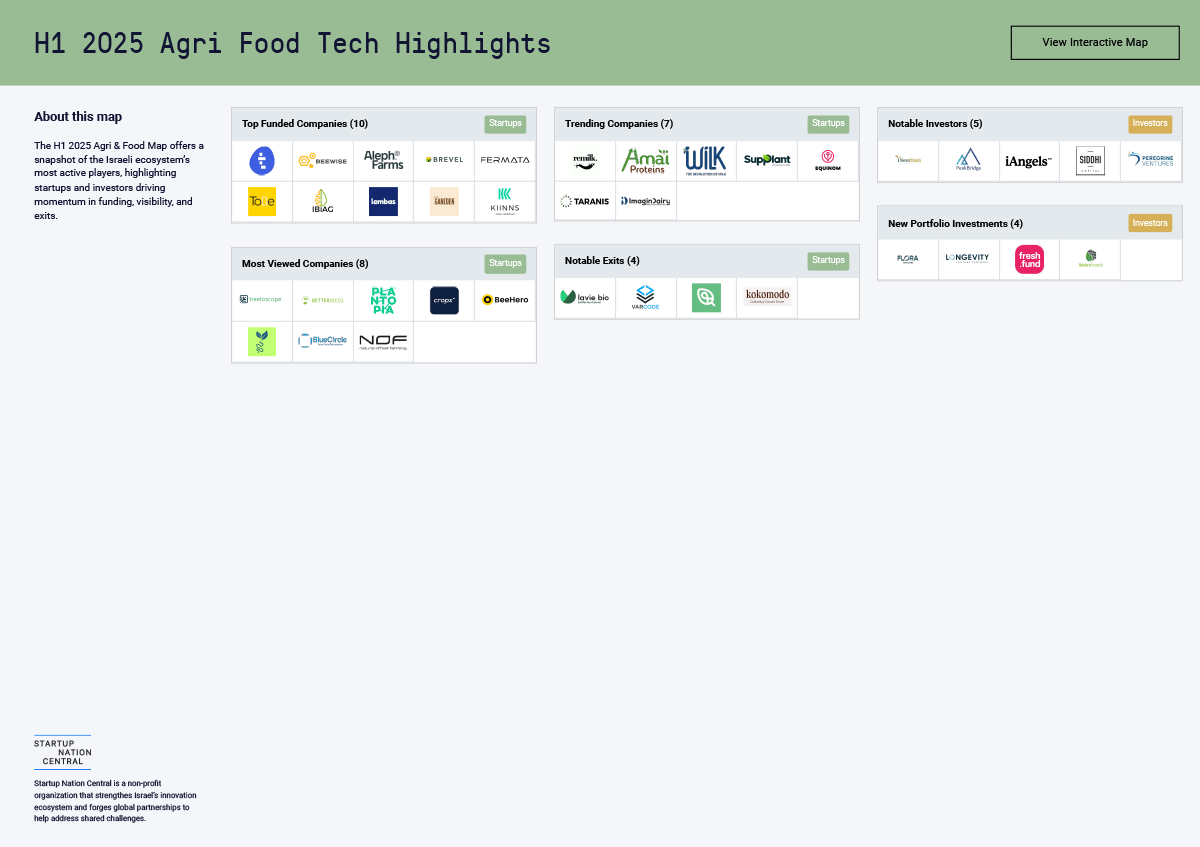

For entrepreneurs, the message is clear: it’s an “age of execution.” Bootstrapping, capital efficiency, and a relentless focus on delivering a product with market traction are paramount. Being agile and flexible in adapting to rapid technological advancements is crucial. Leveraging the existing ecosystem, by engaging with established Israeli tech companies as design partners, provides invaluable feedback and accelerates growth. For global investors, it’s advised to partner with local VCs rather than attempting to invest directly, as the Israeli ecosystem is sophisticated and requires deep, on-the-ground expertise to navigate.

Ultimately, the current landscape presents an unprecedented investment opportunity in Israel. The ecosystem has unequivocally proven its capability to build world-class, category-leading companies. Despite ongoing geopolitical issues, Israeli startups, largely focused on the global market, remain remarkably resilient and continue to attract significant international interest, making the risk-reward profile exceptionally attractive for those with available capital.