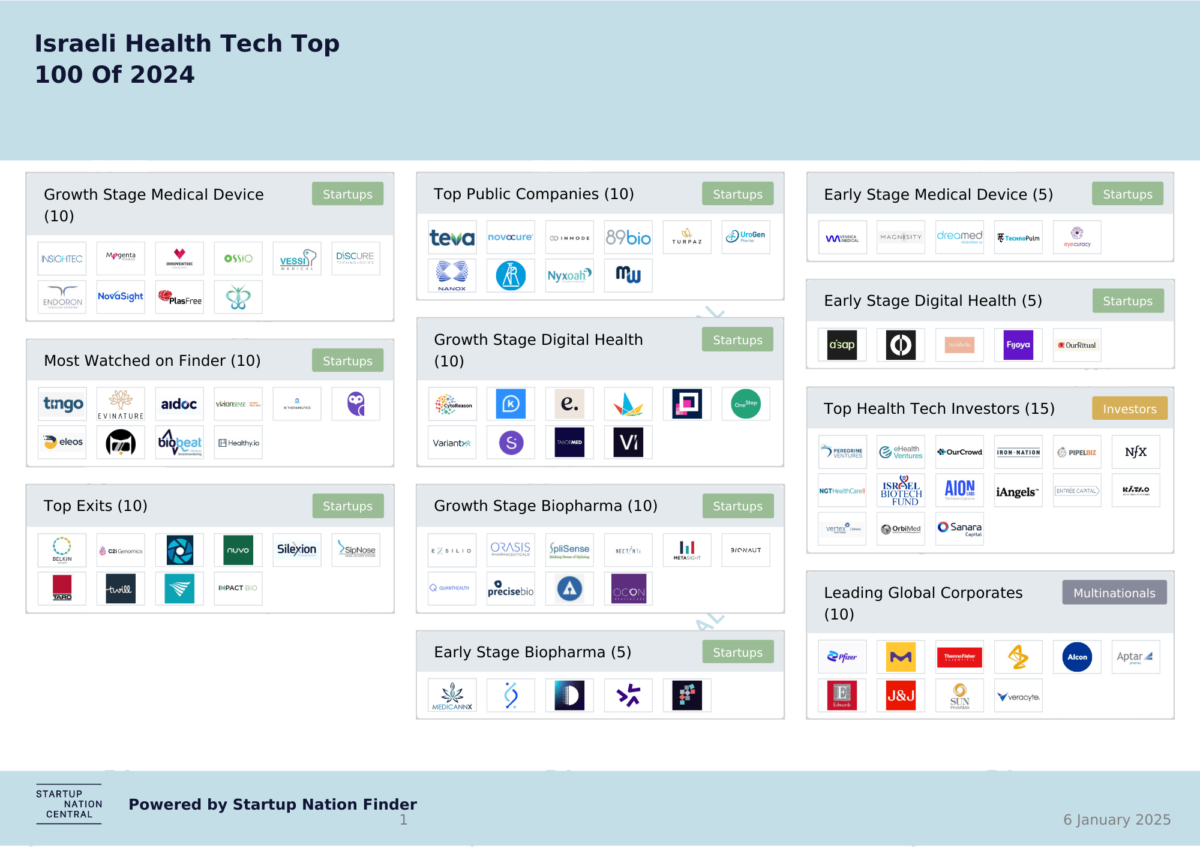

Health Tech

Top 100 of 2024 Landscape Map

Written by: Yael Pomerantz, PhD, Health Tech Sector Lead, Startup Nation Central

Overview

The Health Tech Top 100 of 2024 celebrates Israel’s innovation and transformative impact in health tech. Curated from Startup Nation Central’s Finder platform, this map highlights the ecosystem’s standout investors, companies, and exits.

This resource serves as a go-to guide for understanding key players in biopharma, digital health, and medical devices, the multinational corporations actively engaged in the Israeli market, and the investors fueling these transformative ventures. Despite a year marked by economic uncertainty and geopolitical instability, the Israeli health tech sector continues to reshape global health with bold innovation.

Dive in to explore this dynamic landscape and choose your most promising company of 2025!

Private funding in 2024

Funding Declines Slightly, but Average Deal Size Surges

Health tech private funding in 2024, reaching approximately $1.2 billion, demonstrated sustained momentum with a modest decline from the $1.6 billion raised in 2023. Digital health led the sector, attracting $545 million, followed by medical devices at $380 million and pharma/biotech at $262 million.

A notable trend in 2024 was a significant increase in the average funding amount per deal. Reaching $4.6 million across 102 rounds, this more than doubled the 2023 median of $2.16 million across 150 rounds. This suggests a shift towards larger, more impactful investments within the health tech landscape.

This health tech map spotlights the most impactful startups in digital health, medical devices, and biopharma, showcasing those that secured the largest funding rounds in 2024. These companies exemplify the dynamic investment landscape within the sector.

“Israeli health tech excels in blending top-tier entrepreneurship and tech with strong life sciences capabilities, all supported by government funding. This unique ecosystem drives innovation by connecting life sciences and technology.”

– Mati Gill, AION Labs

Spotlight on Growth Companies

- Insightec (Medical Devices): $150 million investment for its MRI-guided focused ultrasound technology.

- VI Labs (Digital Health): 111M investment for its AI-powered SaaS solutions to improve healthcare outcomes and financial performance for health plans and providers.

- Magenta Medical (Medical Devices): $105 million for its minimally invasive solutions for treating heart failure.

- Exsilio Therapeutics (Biopharma): a record-breaking $82 million Series A funding round for its innovative approach to genomic medicine, which aims to develop redosable therapies for a wide range of diseases.

Noteworthy Early-Stage Deals

To provide a holistic view of the evolving health tech landscape, we included a dedicated section for the most prominent early-stage startups. This showcases those that secured the largest pre-seed and seed funding rounds across digital health, medical devices, and biopharma, offering valuable insights into the sector’s trajectory.

- AISAP (Digital Health): raised $13 million in seed funding to develop and commercialize its AI-powered ultrasound platform, for improving the accuracy and efficiency of cardiac ultrasound examinations.

- DreaMed Diabetes (Medical Devices): secured $3 million in funding and strategic partnerships to develop its AI-powered platform endo.digital solution for personalized insulin treatment.

- Promise Bio (Pharma & Medical Biotechnology): $8.3 million to advance precision medicine with epi-proteomics and AI to predict therapy response.

“In 2024 over a third of digital health funding went to startups that are AI-enabled. Top use case we are seeing are provider support to alleviate burnout and enable efficiency like clinical notes documentation and chart summarization, and also non-clinical provider and payor use cases like revenue cycle management. In the pharma world, R&D enablement and clinical trial optimization are the leading focus areas for AI. Patient facing use cases (across all market segments) are having a slower uptake so far because of the increased risk involved.”

– Sari Kaganoff, Chief Commercial Officer, Rock Health Advisory

Top Investors

We acknowledge the pivotal role of investors in fostering the growth of Israel’s health tech sector. This map features those who made the most health tech investments in Israel in 2024, while also considering their long-term commitment to the sector through previous investment activity.

Some noteworthy investors are:

- Peregrine with 15 investments this year

- eHealth Ventures is an incubator and VC firm with 8 startups in 2024

- Iron Nation is a non-profit organization, also stood out with their support of early-stage ventures that address global health challenges

Exit Activity & Industry Collaboration Fueling Israeli

Health Tech Sector Growth

M&A, Investments, and Venture Creation Drive Innovation and Strengthen Global Impact

2024 witnessed a number of exits, with the medical devices sector leading the way. While IPO activity remained subdued, notable listings like Nuvo Group and Silexion highlight the value of Israeli health tech

Multinational companies are pivotal drivers of Israel’s innovation ecosystem,injecting substantial capital into the economy while also significantly enhancing the global visibility of Israeli technology. These strategic moves foster valuable knowledge transfer, accelerate technological advancements, and create high-value jobs, solidifying Israel’s position as a global innovation hub.

Key Acquisitions in 2024

- Innovalve Bio Medical (Medical Devices) by Edwards Lifesciences

- V-Wave (Medical Devices) by Johnson & Johnson

- C2i Genomics (Medical Devices) by Veracyte

- BELKIN Vision (Medical Devices) by Alcon

- Taro Pharmaceutical Industries (Pharma & Medical Biotechnology) by Sun Pharmaceutical Industries

Beyond acquisitions, multinational corporations are actively investing in promising companies.

- CytoReason, a leader in AI-driven precision medicine, recently secured an $80 million Series C round, attracting investments from industry giants NVIDIA, Pfizer, and Thermo Fisher

“Over the last year, CytoReason has strengthened its platforms using NVIDIA’s latest accelerated computing and AI platforms, achieving more than 10x acceleration for inference workloads. Our continued collaboration with CytoReason will help enable more life sciences companies to benefit from CytoReason’s predictive clinical insights.”

– Kimberly Powell, Vice President and General Manager, Healthcare at NVIDIA

MNCs are forging new paths to fuel early-stage companies through novel venture creation models.

- ProPhet (AI-driven drug discovery) founded by pioneering venture AION Labs attracted a preseed investment by pharmaceutical giants Merck, AstraZeneca, and Pfizer

“Recently, we have noted a growing trend – large med-tech corporations engaging with startups via early-stage investments. These strategic investments are designed to facilitate early, intimate knowledge while influencing and shaping the start-up road map. Such early partnerships can bring needed expertise and certainty to both management and financial investors.

However, this new approach requires the strategic partner to develop early-stage funding tools and terms for young companies. While some strategic partners work diligently toward achieving this goal, others struggle or ignore it. This may lead to some players losing access to meaningful innovative technologies and to a less sophisticated M&A market in the near future.”

– Eyal Lifschitz, Co-founder & Managing General Partner of Peregrine Ventures

Publicly listed companies constitute the pillars of Israel’s health tech ecosystem, characterized by high valuations and significant contributions to global healthcare advancements. This map includes those with the highest market capitalization, signifying their prominent position within the sector.

Among them are the following notable companies:

- Teva Pharmaceutical Industries (Pharma & Medical Biotechnology): A major player in the global pharmaceutical landscape

- NovoCure (Medical Devices): Pioneering non-invasive cancer treatments with its Tumor Treating Fields technology

- Nanox Vision (Medical Devices): Revolutionizing medical imaging with its single-source semiconductor-based X-ray system.

Most Watched Israeli Health Tech Companies

The Finder platform hosts over 1600 profiles of Israeli health tech companies, attracting the attention of a global audience. This includes venture capital analysts, business development professionals seeking partnerships in Israel, and even job seekers.

Among the most viewed companies are notable Israeli success stories such as:

- XRHealth: A pioneering company in the development of immersive therapeutic solutions, leveraging VR and XR technologies to revolutionize healthcare.

- Biobeat: Provides continuous, non-invasive monitoring of vital signs using a proprietary sensor, enabling early detection of patient deterioration and personalized medicine.

- Datos: An AI-powered remote patient monitoring platform that enables healthcare providers to deliver high-quality care to patients at home.

- Aidoc: A leading provider of artificial intelligence healthcare solutions that empower physicians to expedite patient treatment and enhance efficiencies.

- Healthy.io: Empowers patients to conduct at-home medical tests using their smartphones, enabling early diagnosis and improved healthcare outcomes.

Survey: Most Promising Israeli Health Tech Companies

The survey is now closed. Stay tuned for our blog on the results of the survey!

Discover the companies capturing global attention on Finder and select your own!

Join us in identifying the Israeli problem solvers who are driving the healthcare solutions of the future.

About Us

Startup Nation Central is a free-acting NGO providing global solution seekers frictionless access to Israel’s bold and impatient innovators to help tackle the world’s most pressing challenges. Our free business engagement platform, Finder, delivers unrestricted access to real-time, updated information and deep business insights into the Israeli tech ecosystem.

This report was composed by Yael Pomerantz, Health Tech Sector Lead; Eran Igelnik, Business Data Analyst; and Matan Eblagon, Information Specialist.